The holidays are nipping at your heels and there’s still a lot to do! It probably seems like your stress levels keep rising while the money in your wallet keeps dwindling. It doesn’t have to be this way. With a bit of planning, you can enjoy a stress-free and affordable holiday season. Not buying what we’re selling? Well, continue reading to find out how:

The holidays are nipping at your heels and there’s still a lot to do! It probably seems like your stress levels keep rising while the money in your wallet keeps dwindling. It doesn’t have to be this way. With a bit of planning, you can enjoy a stress-free and affordable holiday season. Not buying what we’re selling? Well, continue reading to find out how:

Get prepared with a WECU Christmas Club Account.

It’s never too late to start saving for the holidays! With a White Eagle Christmas Club Account you can save all year long. Open your account today! Christmas Club

Clear the clutter for cash.

Before the holidays, browse your closets for clothing in good condition you no longer wear. Sell these on resale sites like eBay and Craigslist. You’ll make room for any incoming gifts and give your holiday budget a little wiggle room at the same time.

Shop small businesses.

Avoid crowds and enjoy a wider selection of gift items by shopping small businesses this holiday season. Independently owned stores are more likely to be fully stocked, even late in the season. As a bonus, you’re more likely to land unique gifts, and you’ll be helping local businesses stay afloat during these trying economic times.

Suggest a Secret Santa exchange.

If the gift-shopping is getting to be a bit much, consider cutting back by suggesting a Secret Santa gift exchange. You’ll only need to buy one gift instead of one for everyone in an entire group, and the surprise factor makes it super-fun.

Delegate

If you’ll be hosting events this holiday season, delegate jobs to your guests. Everyone will appreciate the opportunity to pitch in, and it’ll be more helpful for you if you can assign specific jobs to each guest, instead of having three different people show up with apple pies.

Shop during non-peak hours

Peak business hours, which start in the early afternoon and run until evening, will have the biggest crowds and emptiest shelves. If you can get to the store early in the day, you’ll enjoy a full selection that you can peacefully browse before crowds show up. Stress-free shopping also means you’re more likely to make responsible spending decisions. Win-win!

Use the tips outlined here for a stress-free and budget-friendly pre-holiday season.

Your Turn: Do you have a fabulous last-minute holiday hack to share? Tell us about it in the comments.

Source: CUContent.com

Learn More:

FamilyEducation.com

Your Summer Fun Awaits! 🚗🌞

Your Summer Fun Awaits! 🚗🌞

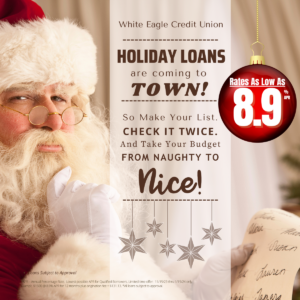

White Eagle CU’s Holiday Loans are coming to town! So make your list. Check it twice. And take your budget from Naughty to NICE!

White Eagle CU’s Holiday Loans are coming to town! So make your list. Check it twice. And take your budget from Naughty to NICE! The holidays are nipping at your heels and there’s still a lot to do! It probably seems like your stress levels keep rising while the money in your wallet keeps dwindling. It doesn’t have to be this way. With a bit of planning, you can enjoy a stress-free and affordable holiday season. Not buying what we’re selling? Well, continue reading to find out how:

The holidays are nipping at your heels and there’s still a lot to do! It probably seems like your stress levels keep rising while the money in your wallet keeps dwindling. It doesn’t have to be this way. With a bit of planning, you can enjoy a stress-free and affordable holiday season. Not buying what we’re selling? Well, continue reading to find out how:

Let White Eagle help you simplify your holiday shopping this year with CUMONEY® Visa® Gift Cards.

Let White Eagle help you simplify your holiday shopping this year with CUMONEY® Visa® Gift Cards.

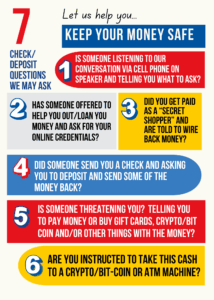

fall for Gift Card Scam. Gift cards are for gifts, not for payments.

fall for Gift Card Scam. Gift cards are for gifts, not for payments. lo Summer” Signature Loan

lo Summer” Signature Loan